Using your WageWorks Healthcare Card

You can use the WageWorks Healthcare Card for all health care expenses, including medical, mental health or substance abuse care, dental and vision expenses, and for prescription drugs and select over-the-counter supplies. However, not all small, independent pharmacies have the correct computer system to validate your transaction, in which case you'll need to pay for the prescription using another form of payment.

Ways to get reimbursed

If you elected the Health Care Flexible Spending Account (FSA), the money in your FSA will be used first to reimburse you for any out-of-pocket health care expenses—since the FSA has a "use-it or lose-it" rule. WageWorks administers your FSA and will automatically debit your FSA first to pay for any out-of-pocket medical expenses. If you don’t have enough in your FSA to cover the expenses, WageWorks will then debit your Health Account. Once you receive your Explanation of Benefits (EOB) from Anthem, Delta Dental or VSP, you can use your WageWorks Healthcare Card to pay your health care provider the amount you owe him or her, as long as you have enough in your Health Account or Health Care FSA. You should always save your receipts and EOBs for IRS purposes.

There are three things you need to know about getting reimbursed through WageWorks

- Claims filing deadline

- When you can use the WageWorks health payment debit card

- Deadline for verifying expenses if you use the WageWorks health payment debit card

|

|

|

|

|

What's the latest you can file a claim? |

|

No deadline* |

|

March 31 for expenses incurred through December 31 of the prior year. |

|

|

Can you use your WageWorks health payment debit card? |

|

Yes—even for prior-year expenses. |

|

Yes for current-year expenses

No for prior–year expenses |

|

|

If WageWorks requests more information—what's the latest you can verify your expense? |

|

March 31 of the year after you use your card |

|

March 31 for expenses incurred through December 31 of the prior year |

*If you waive medical coverage during Open Enrollment, you'll have no Health Account as of January 1 of the following year, and you won't get any new credits. However, you'll have until March 31 of the following year to file Health account claims and verify the prior year's expenses incurred while you were enrolled in the Health Account Plan (HAP).

There are three ways to get reimbursed:

| Pay My Provider |

Pay Me Back |

Manually file claims |

|

Log in to your WageWorks account and use Pay My Provider if you get a bill and you don’t want to use your card.

Pay My Provider sends money to your provider for amounts not paid by insurance.

|

Log in to your WageWorks account and use Pay Me Back if you already paid an eligible expense out of your own pocket.

Download the free WageWorks app—EZ Receipts®—for an easy way to use Pay Me Back.

|

Use the Health Account and Healthcare Flexible Spending Account Claim Form or the Dependent Care Claim Form to file claims with WageWorks. |

|

WageWorks automatically debits your Health Care FSA, if you elected it, and then your Health Account.

Don’t have enough in your Health Account or Health Care FSA to cover the charge? You’ll need to pay with your own money.

|

Tip: Don’t wait!

Send your explanation of benefits (EOB) to WageWorks when you get it—even if you paid with your WageWorks card. Sending the EOB right away will help avoid having your payment delayed. If you need help filing a claim or reimbursement, call the PG&E Benefits Service Center at 1-866-271-8144, and select option 6 for WageWorks.

Set up your WageWorks account

To set up your account, log on to your Mercer BenefitsCentral account and click on WageWorks link. You’ll be able to go straight to your WageWorks account without creating a username and password.

Alternatively, you can log into wageworks.com or use the EZ Receipts app.

WageWorks won’t know who you are—so you’ll need to register your account the first time you visit WageWorks outside of Mercer BenefitsCentral. You’ll need to provide the last four digits of your Social Security number just once—when you register your account.

If your spouse or other close family member needs to obtain WageWorks account information on your behalf complete the HIPAA Authorization Release Form and send it to WageWorks.

Want to authorize someone else to contact WageWorks for you?

Does someone at home handle the bills? Do you want to authorize someone else to contact WageWorks on your behalf?

- Log in to your WageWorks account

- Click Profile > Authorized Individuals

- Complete the requested information

- Click Save Changes

Alternatively, you can complete the HIPAA Authorization Release Form and send it to WageWorks.

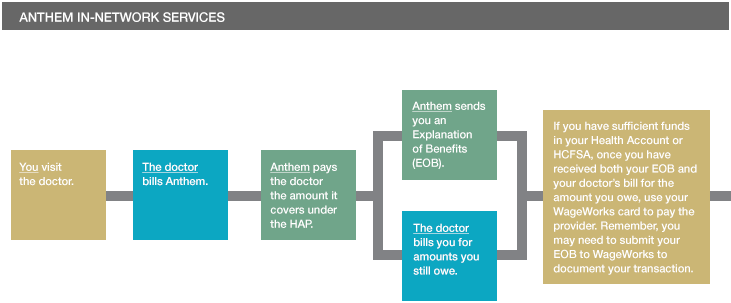

For medical expenses

If you use an in-network provider, you don’t need to file a claim — your doctor will file one with Anthem. Anthem will then pay your doctor amounts it covers under the Health Account Plan (HAP) and send you an Explanation of Benefits (EOB). Once you receive your EOB from Anthem, you can use your WageWorks Healthcare Card to pay your doctor the amount you owe him or her, as long as you have enough in your Health Account or Health Care FSA. You should always save your receipts and EOBs for IRS purposes.

If you use an out-of-network provider, you may need to pay your doctor up front and then file a claim with Anthem. Anthem will then pay your doctor amounts it covers under the HAP and send you an EOB. Once you receive your EOB from Anthem, you can use your WageWorks Healthcare Card to pay your doctor the amount you owe him or her, as long as you have enough in your Health Account or Health Care FSA.

For prescriptions

When you visit the pharmacy you'll need two cards:

- Your Express Scripts ID card tells your pharmacy you're eligible for prescription drug benefits

- Your WageWorks Healthcare Card is loaded with your Health Account credits and — if you elected the Health Care FSA — your annual FSA contribution. However, not all small independent pharmacies have the correct computer system to validate your transaction, in which case you'll need to pay for the prescription using another form of payment

For mental health and preventive substance abuse expenses

After you receive mental health or substance abuse care from a Beacon Health Options (previously ValueOptions) provider, you’ll need to wait a few weeks for Beacon Health Options to process your claim, determine what you owe, and mail you an Explanation of Benefits (EOB) form. Once you receive your EOB from Beacon Health Options, you can use your WageWorks Healthcare Card to pay your health care provider the amount you owe them, as long as you have enough in your Health Account or Health Care FSA. You should always save your receipts and EOBs for IRS purposes.

For dental and vision expenses

You can use your WageWorks Healthcare Card to pay at the time of service, but you may have to submit documentation to WageWorks such as copies of your receipts or Explanation of Benefits (EOB) forms at a later date.

How to ensure your claims are processed correctly

The IRS requires WageWorks to verify all Healthcare card transactions. To ensure your claim is processed correctly, make sure your receipt or explanation of benefits (EOB) has the following five IRS required pieces of information before providing to WageWorks:

IRS Itemized receipt requirements

- Patients Name

- Providers Name

- Date of Service

- Type of Service

- Cost you paid or not reimbursed through your benefit plan

Note, if you don’t provide the IRS-required documentation to verify your purchase as an eligible health expense, you may be taxed on the unverified amount.